London’s Alternative Investment Market (AIM) is a place where many ‘under the radar’ stocks have hidden potential to beat the stock market. So, here are three AIM shares I’ve put on my watchlist to do just that in 2023.

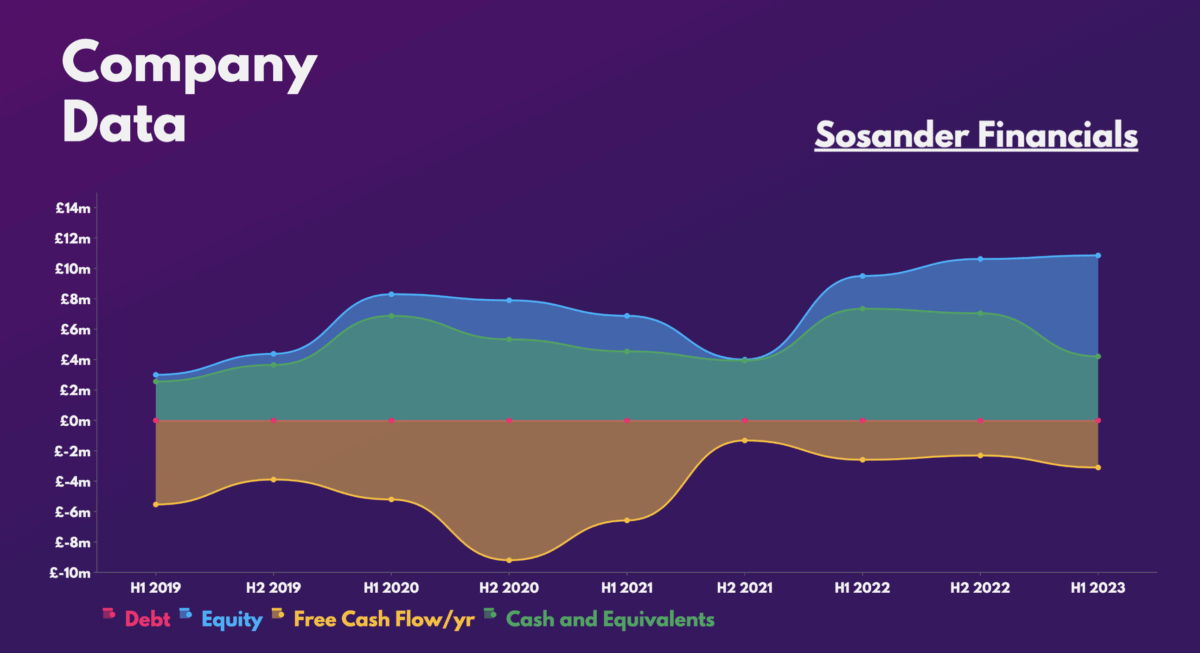

1. Jet2

Like the rest of the travel industry, shares of Jet2 (LSE:JET2) have been performing well recently. The stock is up 30% so far this year and for good reason too. Its most recent trading update was a momentous occasion. That’s because it’s the first FTSE-listed airline to see its load factor finally surpass pre-pandemic levels.

Apart from that though, the budget airline also reported strong sales of packaged holidays and forward bookings. Most importantly, the AIM stalwart shared that it’s now anticipating profits to beat analysts’ estimates of £317m. The firm is now forecasting profit before tax to come in between £370m and £385m. Pair that with an immaculate balance sheet and Jet2 shares certainly look lucrative for my portfolio.

To make things sweeter, the low-cost carrier has very favourable valuation multiples as well. As such, it’s no surprise to see Barclays rating the stock a ‘buy’ with a price target of £13.50. While this only presents a 10% upside from its current levels, I believe the potential for the AIM share is much higher. Therefore, buying at these levels would still give me a good chance at beating the FTSE 100, which averages a 7% return annually.

| Metrics | Valuation multiples | Industry average |

|---|---|---|

| Price-to-book (P/B) ratio | 2.0 | 1.8 |

| Price-to-sales (P/S) ratio | 0.6 | 0.9 |

| Price-to-earnings (P/E) ratio | 15.9 | 11.5 |

| Forward price-to-sales (P/S) ratio | 0.5 | 0.9 |

| Forward price-to-earnings (P/E) ratio | 10.8 | 27.3 |

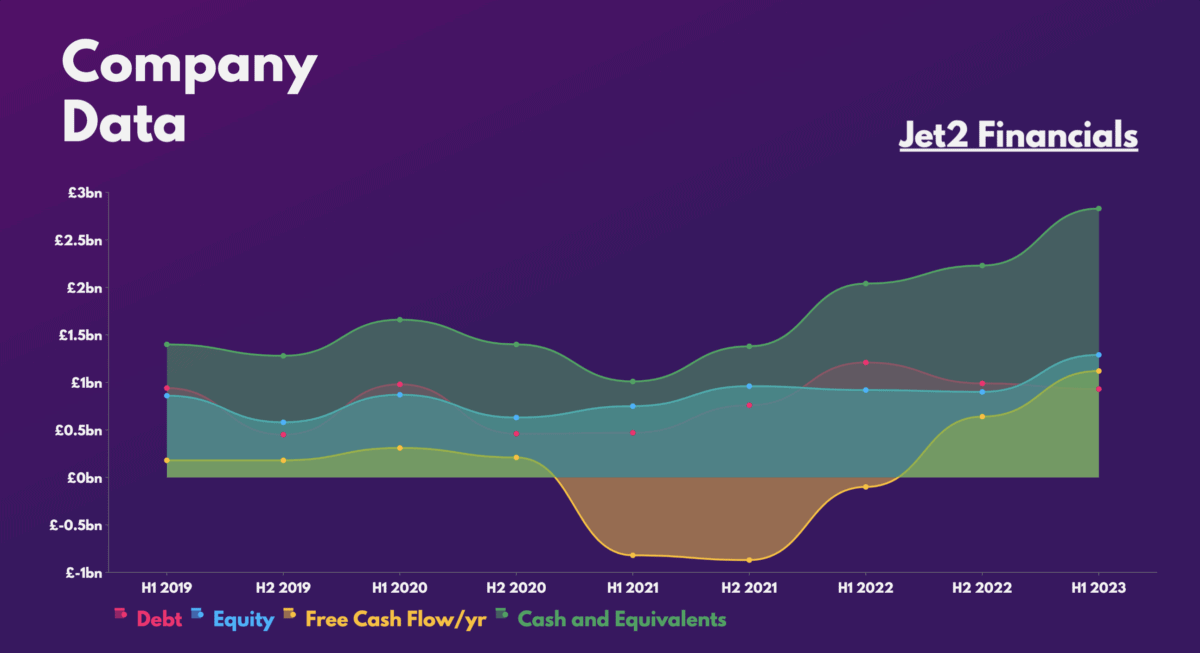

2. On the Beach

On the Beach (LSE:OTB) has also performed well. Shares of the online beach holidays retailer have shot up by an impressive 85% from their October low.

The AIM firm is carrying that strong momentum into 2023 after its latest Q1 update, which saw its share price rise by another 10%. The business recorded higher bookings in what’s usually its quietest quarter of the year, along with strong forward bookings and higher total transactional value (TTV).

What’s more, the group saw growth in its premium, long-haul, and B2B offerings, which tend to be higher-margin products. As a result, I’m expecting growth in these areas to lead to margin expansion, which should bring down its elevated multiples.

| Metrics | Valuation multiples | Industry average |

|---|---|---|

| Price-to-book (P/B) ratio | 1.8 | 1.8 |

| Price-to-sales (P/S) ratio | 2.0 | 0.9 |

| Price-to-earnings (P/E) ratio | 181.1 | 11.5 |

| Forward price-to-sales (P/S) ratio | 1.7 | 0.9 |

| Forward price-to-earnings (P/E) ratio | 19.8 | 27.3 |

Either way, I believe the travel agency’s stock has the potential to beat the market given its strong balance sheet and travel demand. After all, Numis rates it a ‘buy’ with a price target of £2.60, presenting a 50% upside from its current levels.

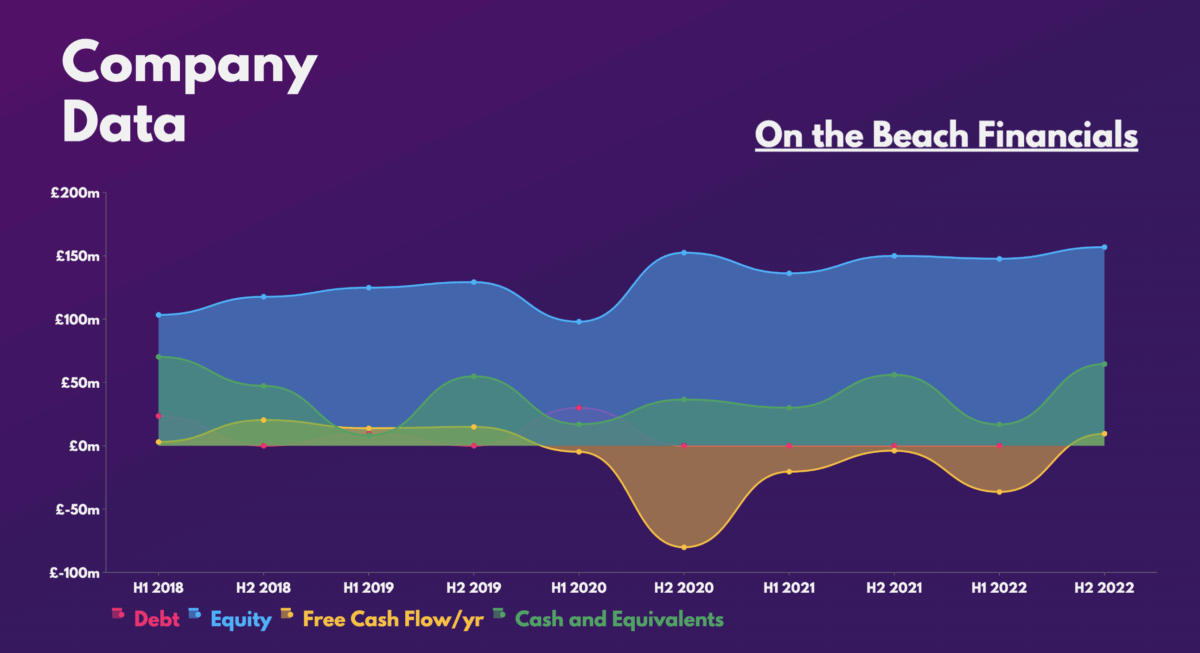

3. Sosander

Another AIM share I’m eyeing is fashion house Sosander (LSE:SOS). The clothes company’s shares are already up 30% this year thanks to its mega deal with Sainsbury’s.

The fashion brand recently penned an agreement with the second-largest retailer in the UK, entering a wholesale agreement to sell its products. Although the initial rollout will be slow, the upside potential is certainly there to be realised. This is especially the case once its clothes start making it onto the racks of selected stores later this year. Higher sales figures would then bring down the shares’ current elevated multiples to more reasonable levels.

| Metrics | Valuation multiples | Industry average |

|---|---|---|

| Price-to-book (P/B) ratio | 5.4 | 1.5 |

| Price-to-sales (P/S) ratio | 1.5 | 0.7 |

| Price-to-earnings (P/E) ratio | 58.0 | 18.3 |

| Forward price-to-sales (P/S) ratio | 1.2 | 0.7 |

| Forward price-to-earnings (P/E) ratio | 31.2 | 18.1 |

Combine the above with its strong financials, and it’s no wonder Sosander shares have an average price target of 35p. With a 32% upside, it’s certainly got the potential to beat the market as well.